Buenos Aires Province’s debt increases as Milei faces a challenge in the local elections. Investors are acquiring debt from Argentina’s largest province, anticipating that President Javier Milei’s political party will maintain its winning momentum in an upcoming local election in under three months. Dollar notes issued by Buenos Aires Province have emerged as the top-performing government credits among emerging markets following the victory of the president’s libertarian bloc, La Libertad Avanza or LLA, in a city hall election in mid-May, as indicated by pricing data compiled by Bloomberg.

Currently, bondholders are betting that Milei, having a firmer hold on the nation’s political right, will be more capable of countering challenges posed by the Peronist opposition in the upcoming legislative contest in the province this September. His allies are presently engaged in efforts to establish an alliance with the PRO party of former president Mauricio Macri to collaboratively nominate candidates in the region. The upcoming vote will act as a significant gauge of voter sentiment in anticipation of the midterm elections in October, during which Milei aims to secure additional seats in both chambers of Congress.

Buenos Aires Province represents over one-third of the nation’s electorate and has a historical tendency to lean towards leftist ideologies. Investment professionals are closely monitoring indicators regarding the ongoing public backing for the government’s stringent austerity measures. Currently, there is a prevailing sense of optimism regarding the president’s prospects. “It appears that LLA and PRO are strategically positioned to increase their influence in the provincial legislature,” remarked Carlos de Sousa, a portfolio manager at Vontobel Asset Management, referencing Milei’s advancements in controlling inflation and stimulating economic growth after a severe recession.

The election prospects for Milei are bolstered by the ongoing tensions among the leaders of Argentina’s centre-left coalition. Following an extended period of exchanges between former president Cristina Fernández de Kirchner and Buenos Aires Province Governor Axel Kicillof, the former declared her candidacy for a position in the provincial legislature on Monday. Kicillof, once viewed as a protégé of Fernández de Kirchner, has in recent months established an independent trajectory as a viable presidential candidate. “This is a power play,” remarked Joaquín Bagues, managing director at local brokerage Grit Capital Group. Kirchner is stating, “‘This is mine.” “If you want it all, you have to beat me here,” he added.

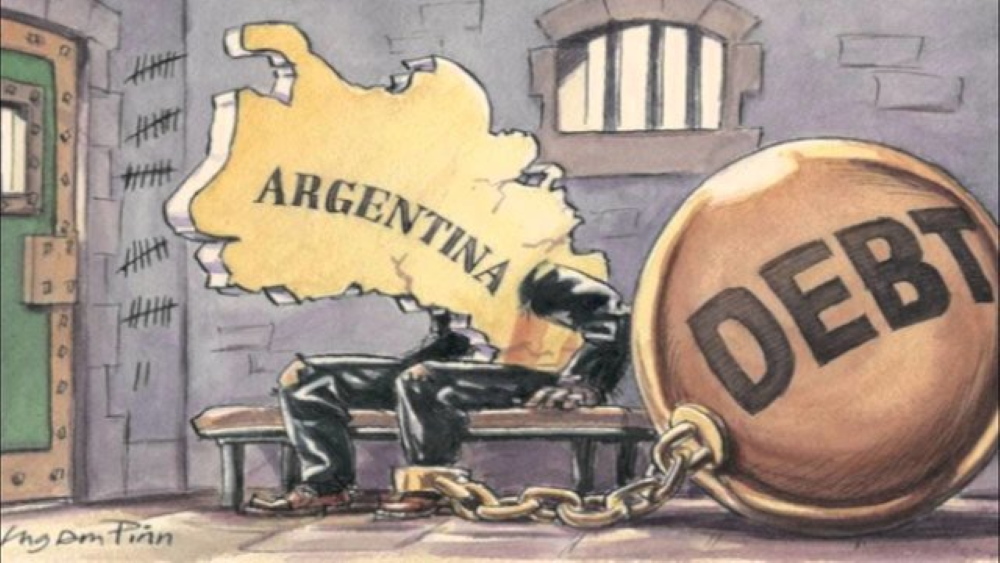

If the divisions on the left continue, it is likely to reduce the additional yield that investors require to hold Buenos Aires Province debt compared to similarly-dated Argentine sovereign bonds to below 200 basis points, as noted by Ramiro Blazquez, a strategist at StoneX. The current risk premium is approximately 240 basis points, a decrease from a peak of about 990 basis points observed in March 2024. The state stands out as one of the rare instances that has not produced a fiscal surplus for a minimum of two decades, as noted by Jefferies strategist Javier Kulesz in a communication dated May 7.

Compounding the difficulties, Buenos Aires Province has shouldered the impact of the president’s expenditure reductions, several of which circumvented legislative approval. The state experienced a significant decline in federal funding in 2024. While some of that money is anticipated to return in 2025, the administration has thus far been “very selective” in distributing additional resources to provinces, according to economists Juan Manuel Pazos and Santiago Resico.

However, a favorable outcome for Milei in the September vote may compel the administration to alter its strategy. According to Graham Stock, senior emerging-markets sovereign strategist with RBC Bluebay, it “opens up the possibility of the province’s leadership being aligned with the national government after 2027.” That could suggest a rebound in discretionary transfers, he noted. Indeed, apprehensions regarding the province’s expenditure have diminished in recent months, as evidenced by its fiscal deficit contracting to US$623 million in 2024 from US$1.17 billion the previous year, based on data compiled by one618. Investors have demonstrated confidence in the province’s capacity to fulfill bond obligations exceeding US$350 million that are due later this year. “Buenos Aires has not only demonstrated resilience to recent economic shocks, but it is also well positioned for the near term,” stated Pablo López, Economy Minister for Buenos Aires Province.