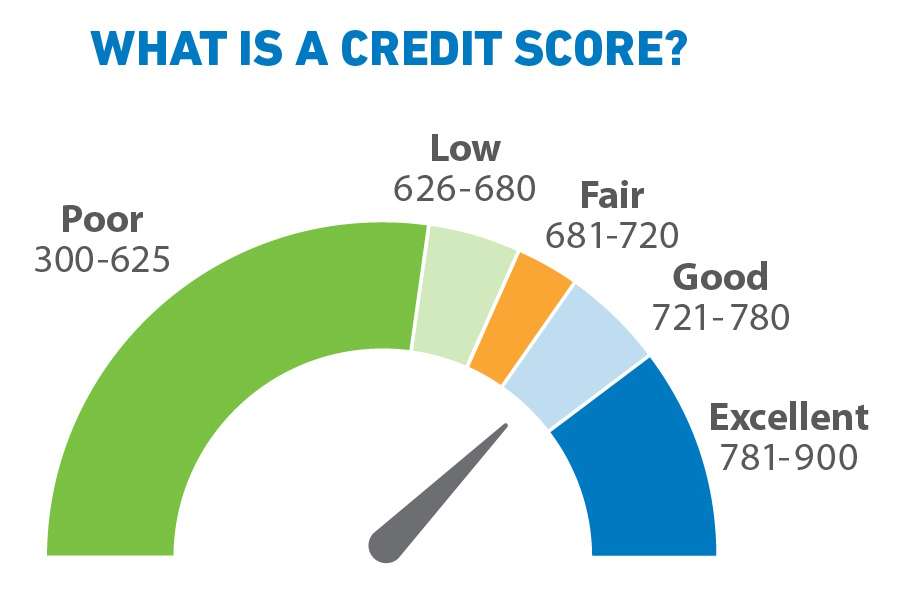

A low credit score could cost you $66,343 more on a 30-year mortgage. Your financial well-being depends significantly on knowing why credit scores matter. These three-digit numbers that range from 300 to 850 can shape your chances of getting loans and determine your payment amounts.

The numbers tell a clear story. Someone with a high credit score (760-850) could lock in a 3.307% interest rate on a $200,000 mortgage and pay $877 monthly. A lower score (620-639) might push that rate to 4.869% with $1,061 monthly payments. Credit scores now reach beyond loans to affect insurance rates and job prospects. Almost a third of Americans had subprime credit scores in 2021. This makes it vital to understand how these scores affect our financial future and what steps lead to improvement.

This piece will get into the hidden factors behind loan approvals and the challenges in traditional credit scoring. You’ll find modern solutions that reshape the scene of credit access for everyone.

How Credit Scores Shape Loan Decisions

Lenders use credit scores as a vital tool to assess borrower risk and make informed lending decisions. FICO® Scores help determine loan approvals and interest rates, with 90% of top US lenders relying on them. The scoring system analyzes five components: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

Credit scores affect loan terms heavily. A $300,000 30-year fixed-rate mortgage shows this clearly – borrowers with credit scores between 760-850 could save $116,354 in interest payments compared to those with scores between 620-639. Lenders also use these scores to set down payment requirements. Borrowers with higher scores might qualify for down payments as low as 3%, while lower scores could require 10-20% or more upfront.

Risk-based pricing helps lenders set interest rates. Borrowers with lower credit scores default at higher rates statistically, so lenders charge them higher interest rates to cover potential losses. Strong credit scores often lead to more flexible terms, including choices between fixed or variable rates and adjustable payment schedules.

Credit scores influence many loan aspects. Mortgage lenders look at scores from all three major credit reporting companies – Equifax, Experian, and TransUnion – and use the middle score to make rate decisions. Conventional loans need a minimum score of 620, though FHA loans may accept scores as low as 580.

High credit scores speed up loan processing. Some mortgage applications get approved within hours instead of weeks. Lenders evaluate credit scores along with debt-to-income ratio, current income, and total assets to get a full picture of creditworthiness.

The best interest rates usually go to borrowers with credit scores above 740. A 100-point drop in credit score could mean paying half a percent more in interest rate – this is a big deal as it means higher long-term borrowing costs.

Hidden Barriers in Credit Scoring

Credit scoring systems contain hidden barriers that hit certain communities harder than others. Recent data shows stark differences – more than 1 in 5 Black consumers and 1 in 9 Hispanic consumers have FICO scores below 620. This contrasts with only 1 in 19 white consumers in this category.

The data collection process creates a major roadblock. Credit scores tend to mirror the lending environment instead of showing a person’s true creditworthiness. Many positive financial behaviors remain unrecognized. Mortgage lenders use older FICO score versions that don’t include regular rental payments and utility bills that consumers pay on time.

These barriers reach beyond simple lending decisions. Credit scores now affect job opportunities, utility service connections, and insurance rates. This expanded use hits marginalized communities especially hard, since studies show credit scores don’t relate to job performance.

Medical debt creates another huge challenge. Medical debt reporting dropped 37% between 2018 and 2022 due to litigation and compliance concerns. Credit scores jumped by an average of 25 points for consumers after medical collections under $500 disappeared from their records.

The system shows more flaws through credit invisibility rates. The Consumer Financial Protection Bureau finds higher rates among Black and Hispanic individuals and people in low-income neighborhoods. Even fair lending defense attorneys who represent major banks admit credit scoring affects people of color differently.

New research shows credit scores are 5% to 10% less accurate for lower-income families and minority borrowers. This gap comes from limited credit histories rather than algorithmic bias. Just one or two small negative marks can severely damage a person’s score.

These obstacles create an unfair cycle. Lower credit scores make homeownership harder to achieve, which damages future credit scores. Communities facing these challenges often resort to high-cost alternative financial services. Some end up paying interest rates as high as 500%. In states like Florida, title loans can be a viable option for those who don’t qualify for traditional financing but need quick access to cash. If you’re considering this alternative, you can learn more about Florida Title Loans.

Modern Solutions Transforming Credit Access

Banks are creating groundbreaking ways to make credit more fair and open to everyone. If you have a thin credit file, credit-building products can help you establish creditworthiness. Credit-builder loans and secured credit cards help prove to lenders that borrowers can handle debt well.

Alternative credit data has changed how lenders look at creditworthiness. Lenders now look beyond traditional metrics by using utility payments, rental history, and cash flow data. This broader approach allows banks to assess 96% of U.S. adults. Millions who couldn’t access credit before now have a chance.

AI has altered the map of credit risk assessment completely. AI models analyze big data sets to spot complex patterns and predict credit risk more accurately. These systems process applications quickly, cutting wait times from weeks to hours while staying objective.

Open Banking brings another breakthrough in credit access. Consumers can share their financial data safely, which helps lenders make better decisions based on live information. Lenders can quickly check if someone can afford a loan and build better credit models for more accurate lending decisions.

Credit-building apps have changed how people build and maintain their credit scores. These apps work in three ways: they monitor credit and suggest improvements, provide credit-building loans, and boost scores through different reporting methods.

The typical credit-builder loan is $724 with a $35 monthly payment, making these products available to many people. Secured credit cards make up 58% of credit-building product balances and usually need a matching cash deposit. These groundbreaking solutions work especially well for younger borrowers aged 25-39, who saw their credit access grow substantially in 2020 and 2021.

Conclusion

Credit scores shape our financial opportunities and influence everything from mortgage rates to job prospects. These three-digit numbers can create a $66,343 difference in mortgage costs alone. This makes them significant factors in smart financial planning.

The traditional credit scoring systems create notable challenges. Minority communities and people with limited credit histories face particular difficulties. Research reveals that Black and Hispanic consumers experience higher rates of low credit scores. Many positive financial behaviors like on-time rent payments remain unrecognized by these systems.

Technology brings new hope and possibilities. Alternative data sources combined with AI-powered assessment models provide fresh paths toward credit accessibility. These trailblazing solutions help millions of previously excluded Americans demonstrate their creditworthiness through non-traditional methods.

A solid understanding of credit scores enables better financial decisions. People can take active steps today to shape their financial future through credit-builder loans, secured credit cards, or careful credit management. The credit scoring systems continue to evolve, and staying informed about these changes helps everyone secure better loan terms and broader financial opportunities.

FAQs

Q1. How does a good credit score impact loan applications? A good credit score significantly improves your chances of loan approval and often results in lower interest rates. This can lead to substantial savings over time, especially for long-term loans like mortgages.

Q2. Why do lenders place such importance on credit scores? Lenders use credit scores as a key indicator of an applicant’s creditworthiness. The score helps them assess the risk of lending and determine appropriate interest rates, making it a crucial factor in their decision-making process.

Q3. Can a credit score affect more than just loan approvals? Yes, credit scores can influence various aspects of your financial life. Beyond loan approvals, they can impact insurance premiums, rental applications, and even employment opportunities in some cases.

Q4. What are some modern alternatives to traditional credit scoring? Recent innovations include the use of alternative data sources like utility payments and rental history, AI-powered credit assessment models, and open banking technologies. These methods aim to provide a more comprehensive view of an individual’s financial responsibility.

Q5. How can someone with limited credit history improve their creditworthiness? There are several options available, including credit-builder loans and secured credit cards. These products are designed to help individuals establish a positive credit history. Additionally, credit-building apps can offer guidance and tools to help improve and maintain good credit scores over time.