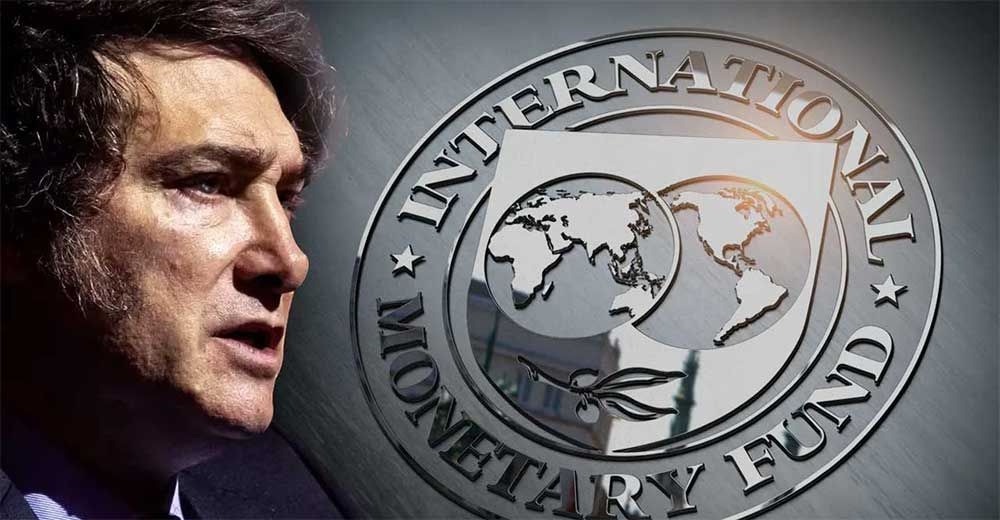

IMF Team Arrives in Buenos Aires

A technical staff team from the International Monetary Fund arrived in Buenos Aires on Thursday, aiming to conduct an audit of Argentina’s economic program. Javier Milei’s administration secured a US$20 billion loan with the Fund last April, adding to an existing US$45 billion debt incurred during Mauricio Macri’s government in 2018. To secure an impending … Read more