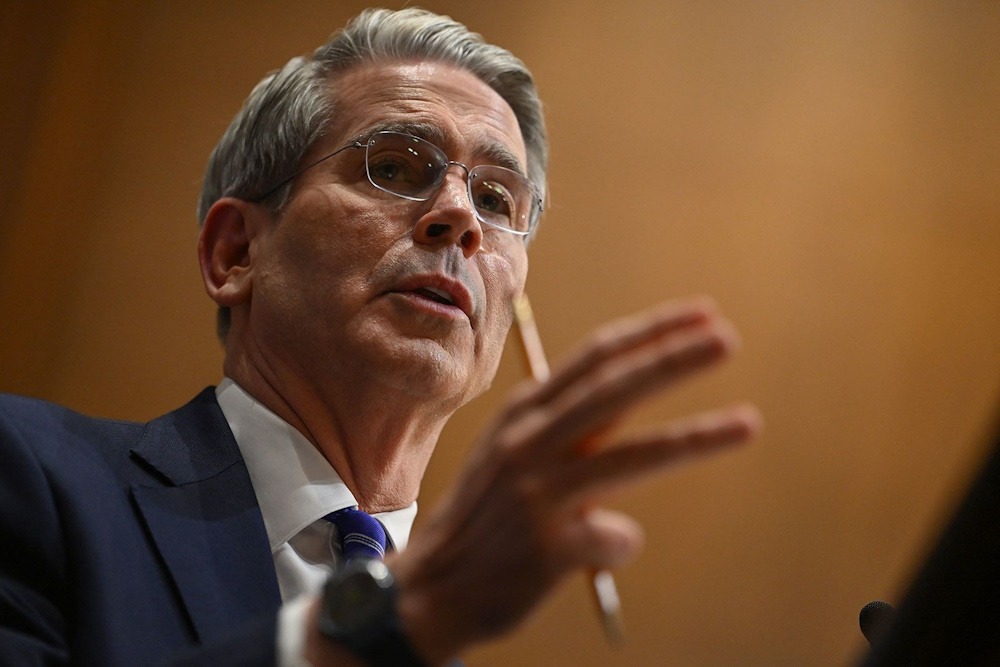

U.S. Treasury Secretary Scott Bessent has declared that the United States acquired pesos in the Argentine market today as part of ongoing negotiations in Washington aimed at supporting President Javier Milei’s administration. Finance specialists remarked that this type of direct intervention in the local forex market by the U.S. was “unheard of.” Bessent stated “Today we directly purchased Argentine pesos.” In an extensive post, the U.S. official remarked: “Argentina faces a moment of acute illiquidity.” The international community, encompassing the International Monetary Fund, stands in solidarity with Argentina and its judicious fiscal approach; however, it is solely the United States that possesses the capacity for prompt action. The announcement followed a week of negotiations in Washington involving officials from Argentina’s economic team, headed by Economy Minister Luis Caputo, and their counterparts from the United States.

The dollar exchange rate serves as a barometer of economic conditions, keenly observed by the Argentine populace. The depreciation of the peso relative to the dollar is interpreted as an indicator of economic instability, potentially triggering inflationary cycles. The intervention by the U.S. Treasury in the exchange market to support the peso was consequently viewed as a direct influence on Argentine matters. Bessent also stated that they “have finalized a $20 billion currency swap framework with Argentina’s central bank. The U.S. Treasury stands ready to implement any necessary exceptional measures to ensure market stability.” In recent weeks, following market skepticism regarding the viability of Argentina’s economic strategy, the government has been utilizing its limited international reserves to prevent a depreciation of the peso. In late September, Milei convened in New York with U.S. President Donald Trump, who stands as his principal international ally. Following the brief meeting, the U.S. Treasury declared its intention to provide a comprehensive bailout for Argentina. On Thursday, Milei expressed gratitude to Bessent for his “strong support for Argentina” and to Trump for his “vision and powerful leadership.”

“Together, as the closest of allies, we will make a hemisphere of economic freedom and prosperity,” he articulated in an uncommon post in English. “We will work hard every day to provide opportunity (sic) for our people,” he stated. Economy Minister Luis Caputo expressed gratitude to Bessent for his steadfast support. “I eagerly anticipate our meeting next week, where I am confident our teams will continue to collaborate with the same spirit of determination and partnership to advance our mutual objectives,” he stated. Between 2:00 p.m. and 3:00 p.m., the wholesale market exchange rate for the dollar declined from AR$1,460 to AR$1,420, igniting speculation regarding a potential intervention by the U.S. Treasury via a local banking institution. Banco Santander sources have confirmed that a communication was dispatched to their clients stating that the bank “executed transactions on behalf of the U.S. Treasury for the purpose of foreign exchange intervention.” The transaction entailed the transfer of dollars to the account of Banco Santander located in the United States. A source with knowledge of the matter informed that the funds were subsequently dispatched to the branch in Argentina, where they were exchanged for pesos on the local market. U.S. aid to Argentina encompasses specialized support from the International Monetary Fund. Kristalina Georgieva, informed that the IMF is collaborating closely with the U.S., the World Bank, and the Inter-American Development Bank to formulate an aid package for Argentina. Georgieva indicated that the assistance might be structured as a loan utilizing the US’s Special Drawing Rights, akin to the approach taken by Qatar in 2023 during Sergio Massa’s tenure as economy minister.

At that moment, the Argentine government had arranged a “bridge” loan with Qatar, utilizing Qatari SDRs to fulfill a maturity obligation with the IMF. Gustavo Quintana, noted that Bessent’s remarks align with the developments observed in the exchange market on Thursday. “There was significant supply in the market, which depressed prices, bringing them below yesterday’s closing levels,” Quintana stated. The broker indicates that the US Treasury’s intervention was executed via other financial institutions, given its lack of authorization to engage directly in the Argentine market. “The Treasury lacks the authority to act directly in this manner.” However, it operates similarly to any other entity, engaging in transactions with banks, which subsequently sell in the market,” he explained. Quintana indicated that the U.S. Treasury is anticipated to “sell dollars and buy Argentine assets with pesos.” One of the banks anticipated to engage in the transactions verified this information. “The exchange rate tension could certainly diminish, with the unwinding of dollar positions.” Quintana remarked “It is truly unprecedented.”