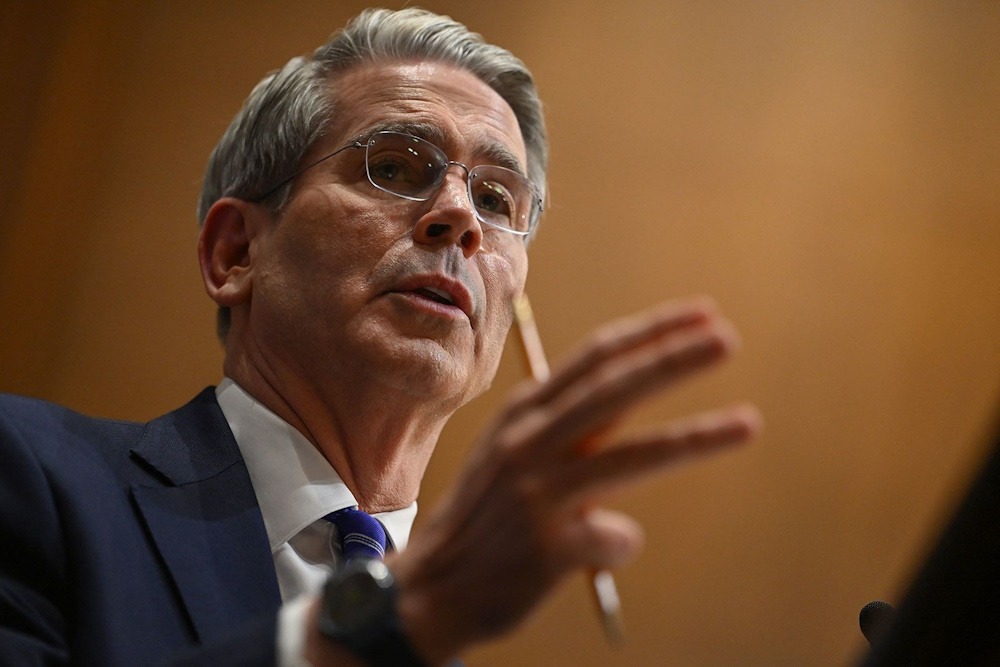

The U.S. government acquired pesos in the Argentine foreign exchange market, as announced by Treasury Secretary Scott Bessent on Friday; however, this intervention did not suffice to prevent the peso from depreciating against the dollar. On the same day, the International Monetary Fund emphasized that Argentina ought to enhance its reserve accumulation efforts. “Yesterday, Treasury acquired pesos in the ‘Blue Chip Swap’ and spot markets,” Bessent noted on X. Since last week, the U.S. Treasury has engaged in the purchase of pesos, effectively selling U.S. dollars in the foreign exchange market, in an effort to mitigate the ongoing pressure on the peso. Friday’s announcement indicates that it is also engaging in the financial market.

Bessent stated that the U.S. government is “in close communication” with Argentina’s economic team. “Treasury is monitoring all markets, and we possess the ability to act with both flexibility and decisiveness to stabilize Argentina,” he stated. However, the peso experienced a significant decline across all markets — the official wholesale rate increased by 3.8%, rising from AR$1,446 on Thursday to AR$1,455 on Friday, while the blue-chip swap rate escalated from AR$1,491 to AR$1,543.7, reflecting a 3.5% variation. Financial analysts have indicated that the U.S. Treasury’s dollars appear insufficient, as Argentines demonstrate a strong inclination to dollarize their portfolios.

“The issue at hand is that the government seeks to establish the value of the dollar. At the price established, the quantity of dollars that demand is prepared to purchase significantly exceeds the quantity that supply is ready to sell,” economist Christian Buteler stated. “It’s not about disregarding the capabilities of the US Treasury, nor is it about confronting Uncle Scotty — it’s fundamentally a question of supply and demand.” On Friday Nigel Chalk remarked that “the support from the US Treasury is helping to stabilize markets and it will complement the fund-supported program.”

However, he added that Argentina should apply “a consistent set of macroeconomic policies — that includes policies to reduce inflation, reserve accumulation, but also policies that will create the foundation for strong and sustained growth.” The Fund has consistently advocated for Argentina to build its international reserves; however, analysts concur that the government’s focus has been on disinflation instead.